Hsa Married Limit 2025. You can contribute the following amounts to an hsa in 2025 if you have an eligible hdhp: In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans.

Keep in mind, there’s also a limit to how much you can contribute to your hsa each year. You could have made a 2025 contribution until the tax filing deadline in 2025.

In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans.

Hsa Contribution Limits 2025 Married Filing Jointly Brandi Estrella, The short answer is yes, you can use your hsa for your. Find out the max you can contribute to your health savings account (hsa) this year and other important hsa account rules.

New HSA/HDHP Limits for 2025 Miller Johnson, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually. If you have family coverage, you can.

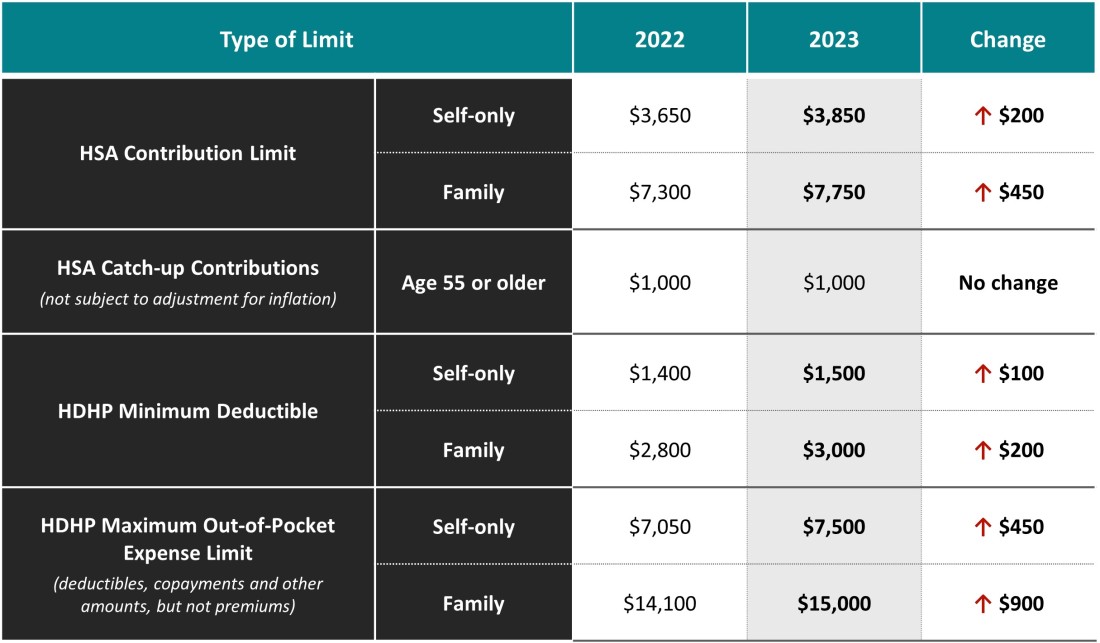

2025 HSA and HDHP Limits Free Chart, Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to $8,300. On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025.

.png)

Irs Announces Updated Hsa Limits For First Dollar 19257 Hot Sex Picture, In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

2025 HSA Contribution Limit in the USA Everything You Need to Know, Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to $8,300. According to rhinehart, for 2025, hsa contribution limits are $4,150 for.

HSA/HDHP Limits Increase for 2025 Blog Strategic Services Group, Maximum contribution limits are based on the calendar year, meaning. Keep in mind, there’s also a limit to how much you can contribute to your hsa each year.

HSA/HDHP Contribution Limits Increase for 2025, For family coverage, the limit will be $8,300 (an over 7% rise from $7,750). The hsa contribution limit for family coverage is $8,300.

2025 HSA Limits CostofLiving Adjustments Released by IRS BASIC, For family coverage, the limit will be $8,300 (an over 7% rise from $7,750). Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Hsa Deduction Amount For 2025 Married Filing Enid Odelia, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. Find out the max you can contribute to your health savings account (hsa) this year and other important hsa account rules.

Hsa 2025 Contribution Limit Chart By Year Sheba Domeniga, The hsa contribution limit for family coverage is $8,300. The annual limit on hsa.

Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

DIY Tutorials WordPress Theme By WP Elemento